Arriba 97+ imagen office deduction

Introduzir imagem office deduction.

The Home Office Deduction – TurboTax Tax Tips & Videos

![The Best Home Office Deduction Worksheet for Excel [Free Template] The Best Home Office Deduction Worksheet for Excel [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349b18d4a6db382f5149518_home-office-expense-worksheet.png)

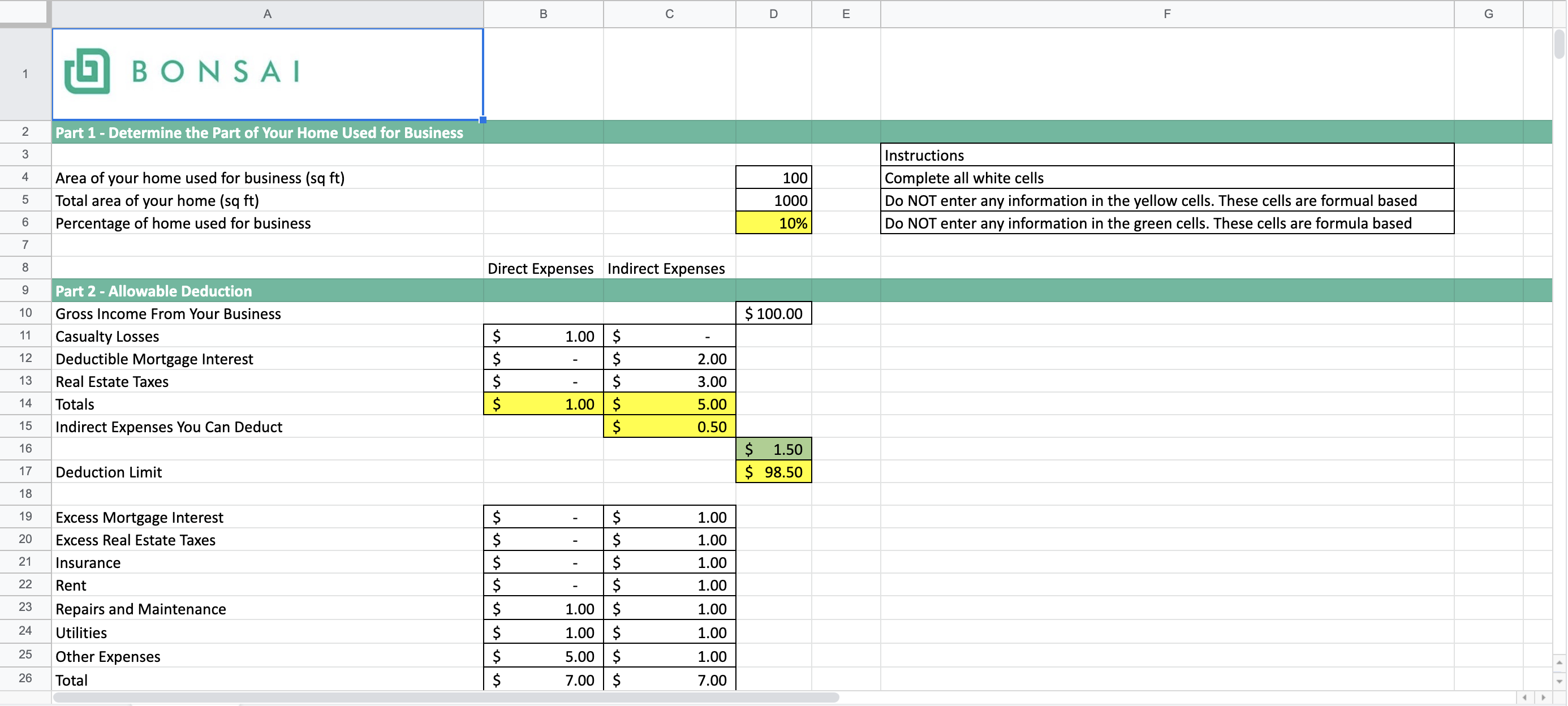

The Best Home Office Deduction Worksheet for Excel [Free Template]

Home Office Tax Deduction: What Is it, and How Can it Help You?

Home Office Deduction – Taxed Right

Home Office Deduction Pointers for Federal Taxes | Credit Karma

Home Office Tax Deductions for Home-Based Workers

Simplified Home Office Deduction: When Does It Benefit Taxpayers?

UNLOCK A HOME OFFICE DEDUCTION – Credo CFOs & CPAs

Simplified Home Office Deduction: When Does It Benefit Taxpayers?

Simplified Home Office Deduction Explained: Should I Use It?

How To Deduct Your Home Office On Your Taxes – Forbes Advisor

Deducting a Home Office | Perkins & Co

Your Home Office & Tax Deductions for Small Business

Home Office Tax Deduction: What Is it, and How Can it Help You?

Claiming the Home Office Deduction | Jones & Roth CPAs & Business Advisors

Do You Qualify for a Home Office Tax Deduction? | Square

What You Can Claim as Home Office Deductions | QuickBooks Canada

How To Deduct Your Home Office On Your Taxes – Forbes Advisor

Home Office Tax Deduction in 2022 – New Updates | TaxAct

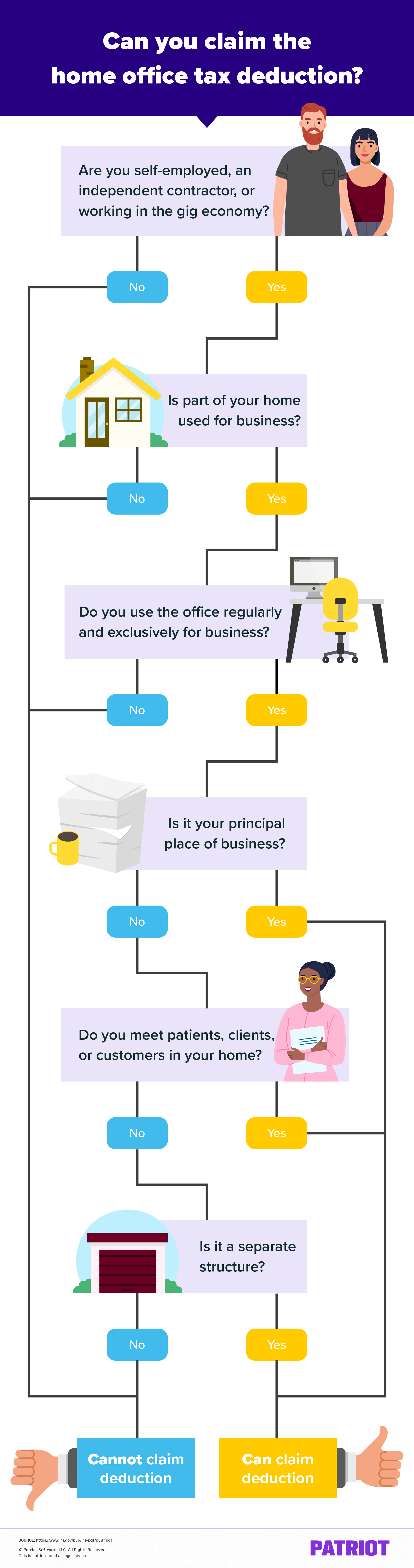

Can You Take the Home Office Deduction?

Here’s who can claim the home-office tax deduction this year

![Can I Take the Home Office Deduction? [Free Quiz] Can I Take the Home Office Deduction? [Free Quiz]](https://assets-global.website-files.com/5cdcb07b95678daa55f2bd83/635c647797c263283309177a_Home%20Office%20Guide%20(5).png)

Can I Take the Home Office Deduction? [Free Quiz]

Do I Qualify for a Home Office Tax Deduction? | Velocity Micro

Working From Home: Can Federal Employees Claim A Home Office Tax Deduction?

5 Things to Remember about the Home Office Deduction –

Home Office Tax Deduction| White Coat Investor

Home office tax deduction still available, just not for COVID-displaced employees working from home – Don’t Mess With Taxes

How to claim the home office deduction | LegalZoom

Can I take a Home Office Tax Deduction? –

Home Office Deduction | HouseLogic

:max_bytes(150000):strip_icc()/450824025-F-56a938665f9b58b7d0f95be1.jpg)

Rules for Deducting Business Expenses on Federal Taxes

The shortcut to claiming COVID-19 home office deductions | Small Business Development Corporation

How to know if you can claim the home office deduction on your taxes

Rev. Proc. 2013-13: A New Option for the Home Office Deduction

Qualifying for the Home Office Deduction | Robert A. ”Rocky” Mills, MBA

How to Claim the IRS Home Office Deduction while Living Abroad

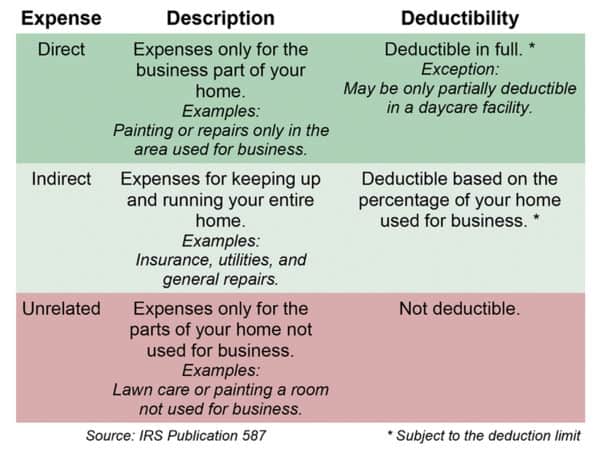

Home Office Deductions: Everything You Need to Know: Who’s Eligible and How to Calculate Them

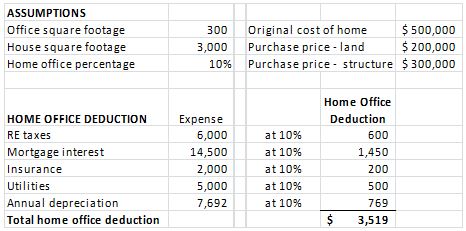

Home Office Deduction Calculator -2023

Working From Home? Home Office Tax Deduction – Ramsey

how to claim the home office deduction as a digital nomad — Blog — Nuventure CPA LLC

Did Tax Reform Change Your Home Office Tax Deduction?

5 Home Office Deductions You Should Know About | Epic Office Furniture

4 Myths About the Home Office Tax Deduction | Money

Home Office Tax Deduction Guide: Different Expense Methods & More!

FREE Home Office Deduction Worksheet (Excel) For Taxes

Taking A Home Office Deduction | The Amboy Guardian

Can Renters Claim A Home Office Deduction? – Money Matters – Trulia Blog

Tips on calculating tax deductions for your home office expenses | Prospa

California Home Office Deduction | Robert Hall & Associates

Home Office Deduction: Which Expenses Can You Deduct?

How Writers Can Maximize A Home Office Deduction Every Tax Year | Writers Room CPA

Q&A: No Business Income, No Home-Office Deduction: Wrong

Self-Employment Tax Deductions: How to optimize your home office deduction? | Marca

The Home Office Deduction Using the Simplified Method – TaxSlayer Pro’s Blog for Professional Tax Preparers

Cheap Sheets: CPA Prepared Home Office Deduction Worksheet. – Etsy

The Pros and Cons of the Home Office Deduction | Finance Tips – Business Accounting Blog

Home Office Deduction, Schedule C, Form 1040, Form 8829. How to write off your home office. – YouTube

:max_bytes(150000):strip_icc()/HomeOfficeDeduction-46bf6befa1de4a1a9972d9a642464cbc.jpeg)

What Is the Home Office Tax Deduction (and How To Calculate It)

Home Office Tax Deduction 2023 – Blog – Akaunting

Can you claim the home office tax deduction if you’ve been working remotely? Here’s who qualifies – MarketWatch

Home Office Deduction Can Help Small Businesses – Taxing Subjects

Home Office Deduction | Permissible Expenses | Virginia CPA

Home Office Deduction: What You Need to Know – Shared Economy Tax

Home office tax deduction still available, just not for COVID-displaced employees working from home – Don’t Mess With Taxes

Tips for work from home tax deductions | LegalZoom

Home Office Deduction Explained: How to Write Off Home Office Expenses & Save on Taxes – YouTube

What You Need to Know About the Home-Office Deduction – WSJ

The home office deduction: Why you probably can’t claim it, even if you work from home – CNET

How to know if you qualify for the home office deduction

6 Printable home office deduction worksheet Forms and Templates – Fillable Samples in PDF, Word to Download | pdfFiller

Home Office Deductions for Bloggers – Simple Blog Taxes

How To Deduct Your Home Office On Your Taxes – Forbes Advisor

Taxes 2023: Do You Qualify for a Home Office Deduction?

Home Office Deduction for Real Estate Investors – DMLO CPAs

The Home Office Deduction – Simplified Vs Actual Expense Method

How Do I Calculate My Home Office Deduction? | 1-800Accountant

Home Office Tax Deduction | Massey & Company CPA | Atlanta, GA

Do You Qualify for a Home Office Deduction?

Home Office Tax Deduction for Self Employed (What Can You Deduct?)

Home Office Deduction – NumberSquad

Can I write off home office expenses during the pandemic?

Home Business Tax Deduction for Two Businesses | H&R Block

Tax Equity Requires Reinstating the Home Office Deduction” – Law360 | Becker

Does Your Home Office Qualify for a Tax Deduction? | Carr, Riggs & Ingram

Simplified Home Office Deductions

Home Office Tax Deduction Explained

Ultimate Guide to the Home Office Tax Deduction – TaxSlayer®

Tax Season 2023: What You Need to Know About Home Office Deductions – Pacific Tax & Financial Group

How Does the Home Office Deduction Work?

Making Your Home Office a Tax Deduction – Alloy Silverstein

Are Pastors Eligible for the Home Office Tax Deduction? – The Pastor’s Wallet

Can You Deduct Your Home Office on Your Taxes? | Advice Chaser

About the Home Office Deduction – Dalby, Wendland & Co., .

Form 8829 for the Home Office Deduction | Credit Karma

Home Office Expenses: The Essential Guide – BOX Advisory Services

5 Home Office Deduction Mistakes – Beene Garter, A Doeren Mayhew Firm

The Home Office Deduction Can Bring Big Tax Savings – Michele Cagan, CPA

Publicaciones: office deduction

Categorías: Coffee

Autor: Abzlocalmx

Reino de España

Mexico