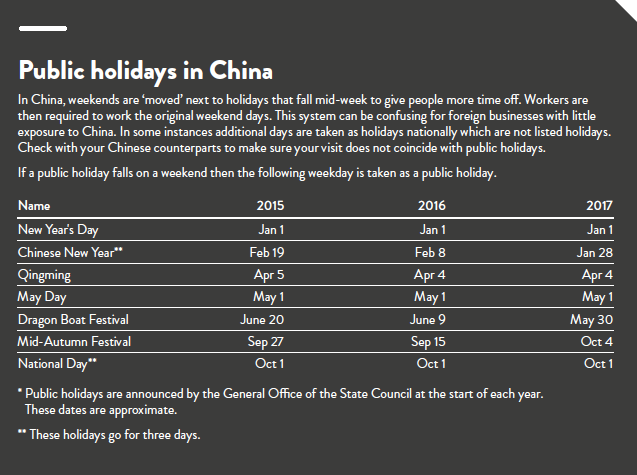

Arriba 57+ imagen schedule c office expense

Introduzir imagem schedule c office expense.

A Friendly Guide to Schedule C Tax Forms (.) | FreshBooks Blog

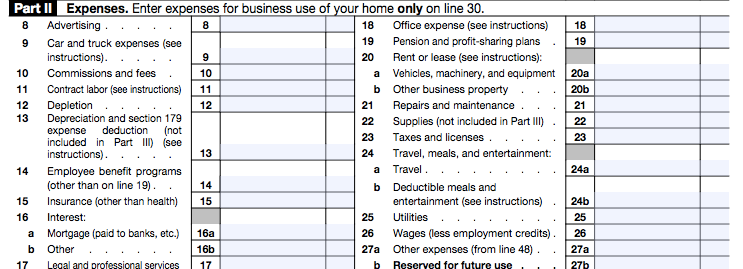

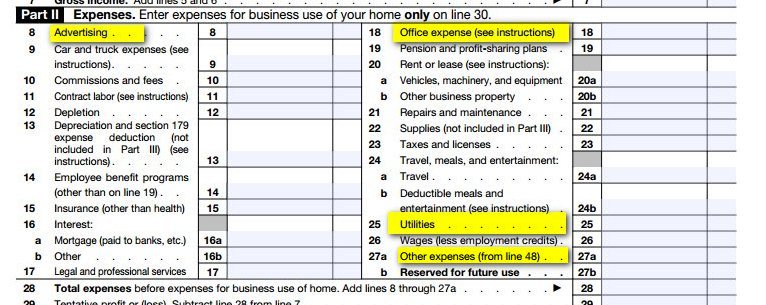

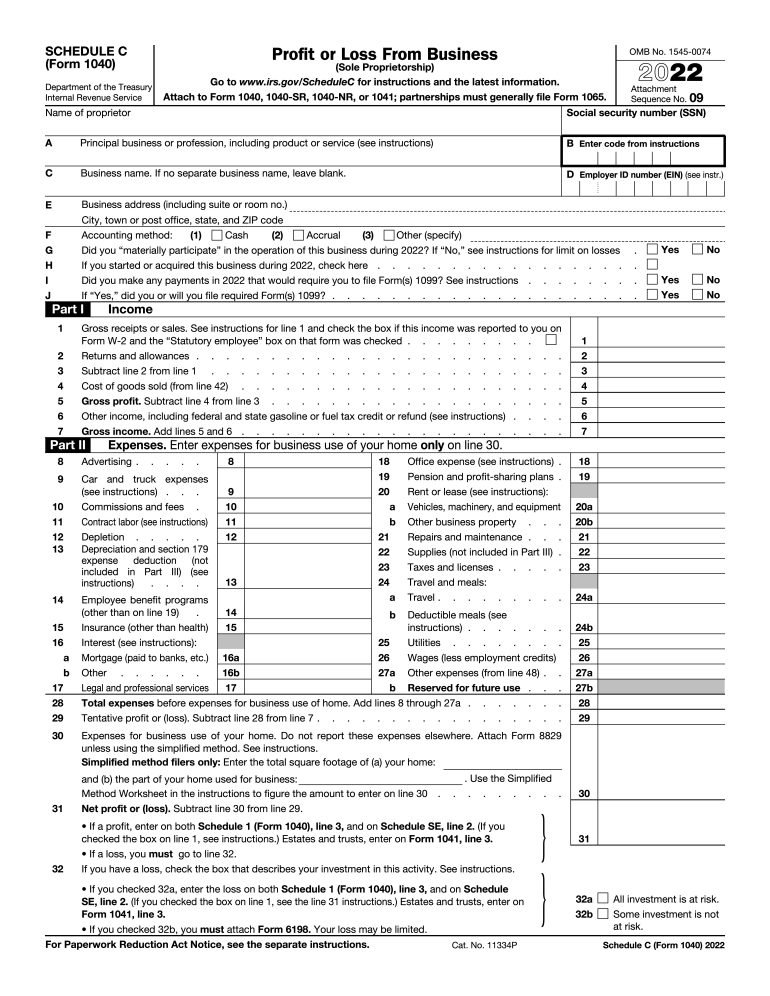

What do the Expense entries on the Schedule C mean? – Support

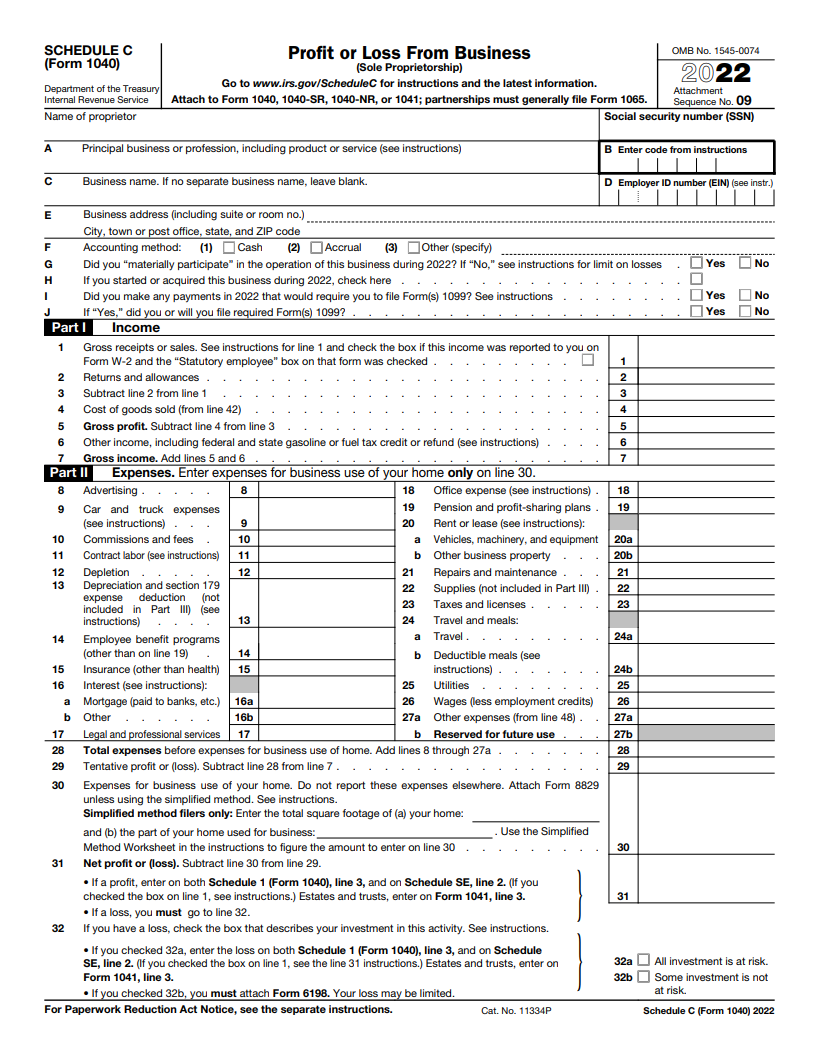

How to Fill Out Your Schedule C Perfectly (With Examples!)

What do the Expense entries on the Schedule C mean? – Support

:max_bytes(150000):strip_icc()/ScheduleC1-7818321402c0410ba4c212ca697c6227.jpg)

What Is Schedule C? Who Can File and How to File for Taxes

What to Know About Schedule C Form to File Your Taxes — Stride Blog

Writing off Business Expenses With Schedule C – Ride Free Fearless Money

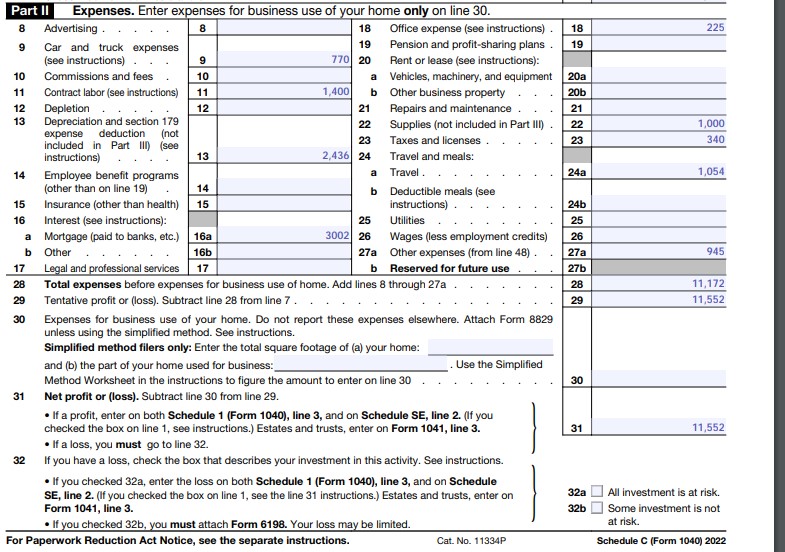

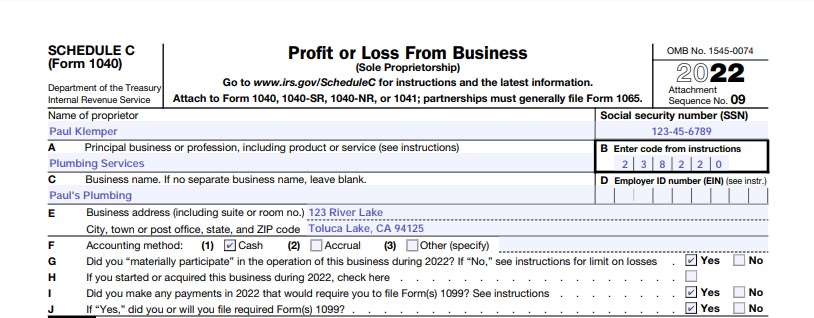

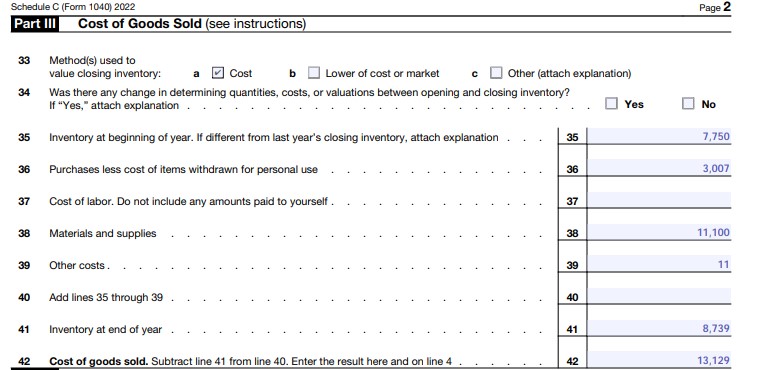

How To Fill Out Your 2022 Schedule C (With Example)

Deducting business meals & other expenses on Schedule C – Don’t Mess With Taxes

How To File Schedule C Form 1040 | Bench Accounting

Where Do I Deduct Website Expenses on Schedule C – Taxes

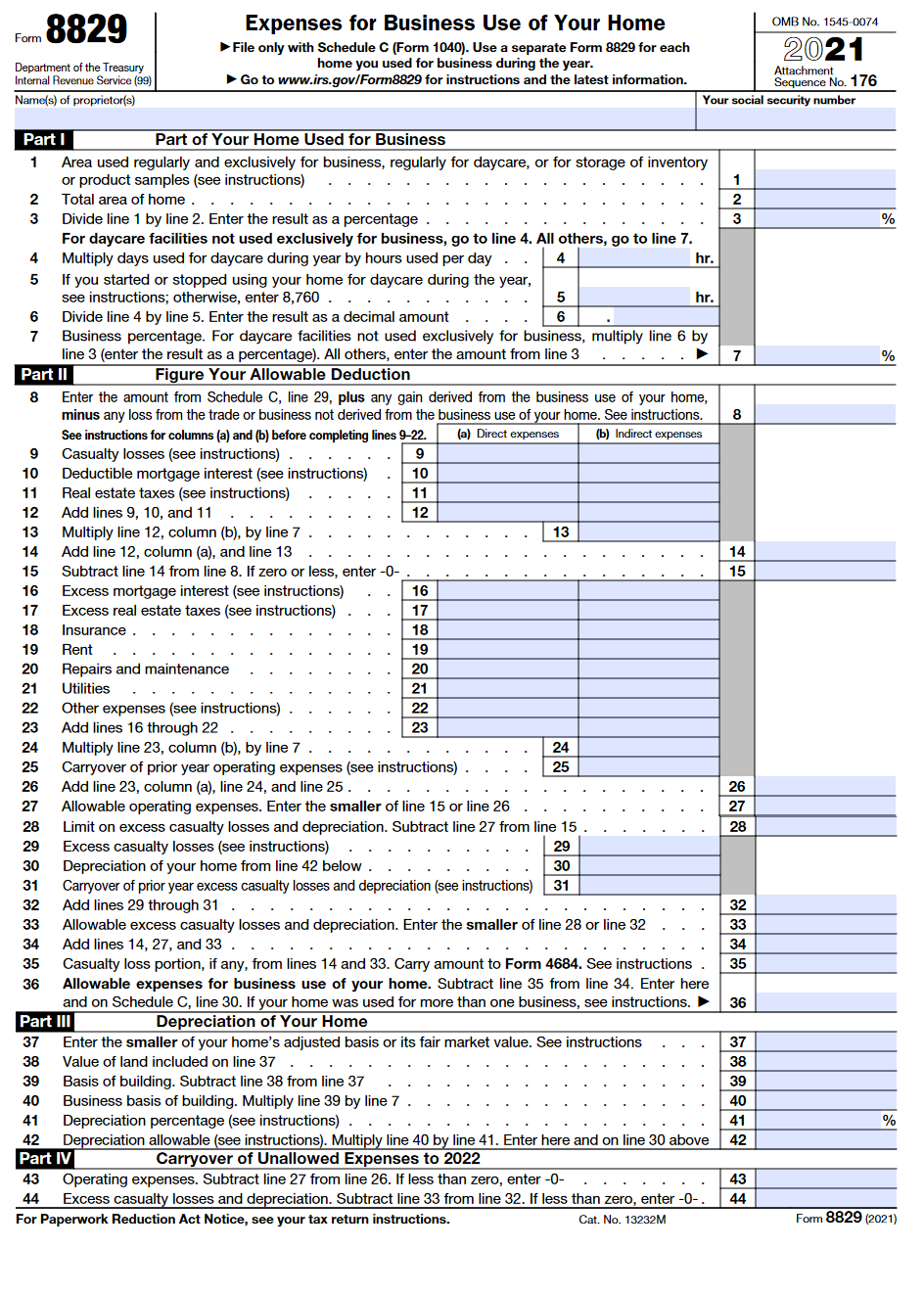

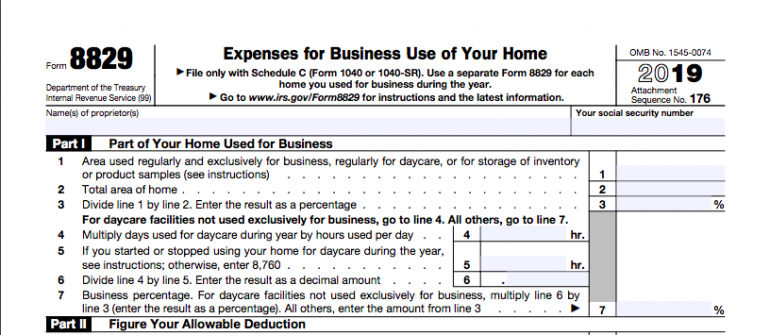

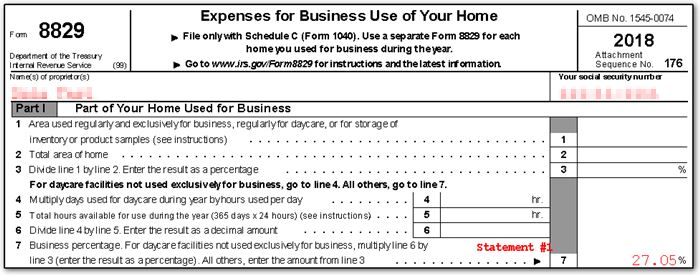

How to Claim the Home Office Deduction with Form 8829 | Ask Gusto

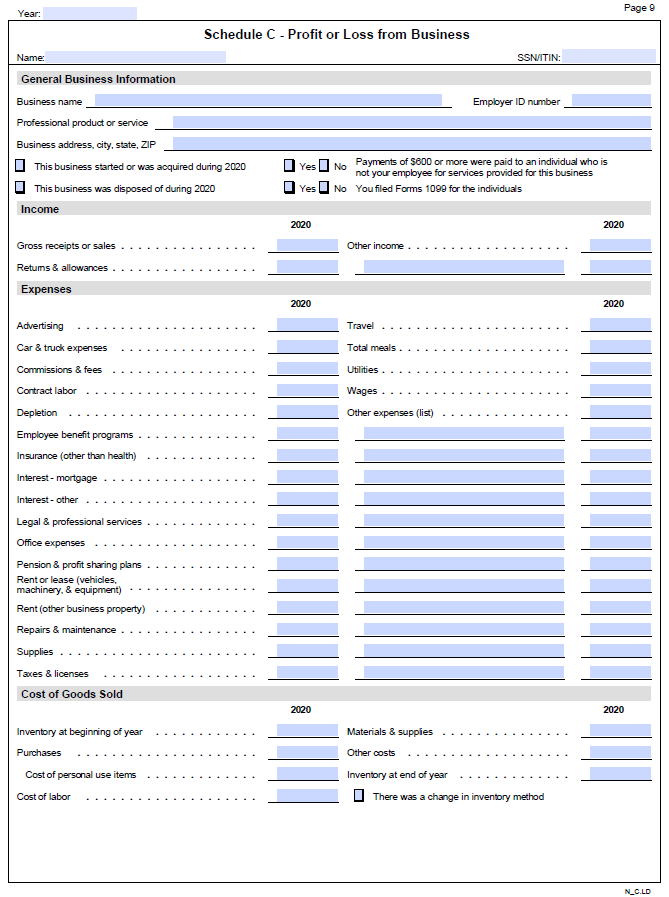

Schedule C Small Business Organizer – Daniel Ahart Tax Service®

Schedule C 1040 line 31 Self employed tax MAGI instructions home office

Schedule C Instructions: How to Fill Out Form 1040 – Excel Capital

SCHEDULE C – Office Expense, Supplies, Travel, Deductible Meals // Tax for Photographers – YouTube

Solved SCHEDULE C (Form 1040) Profit or Loss From Business

Schedule C Expenses Worksheet – Fill Online, Printable, Fillable, Blank | pdfFiller

The ultimate guide to self-employed tax deductions

Deducting business meals & other expenses on Schedule C – Don’t Mess With Taxes

How to Fill Out Your Schedule C Perfectly (With Examples!)

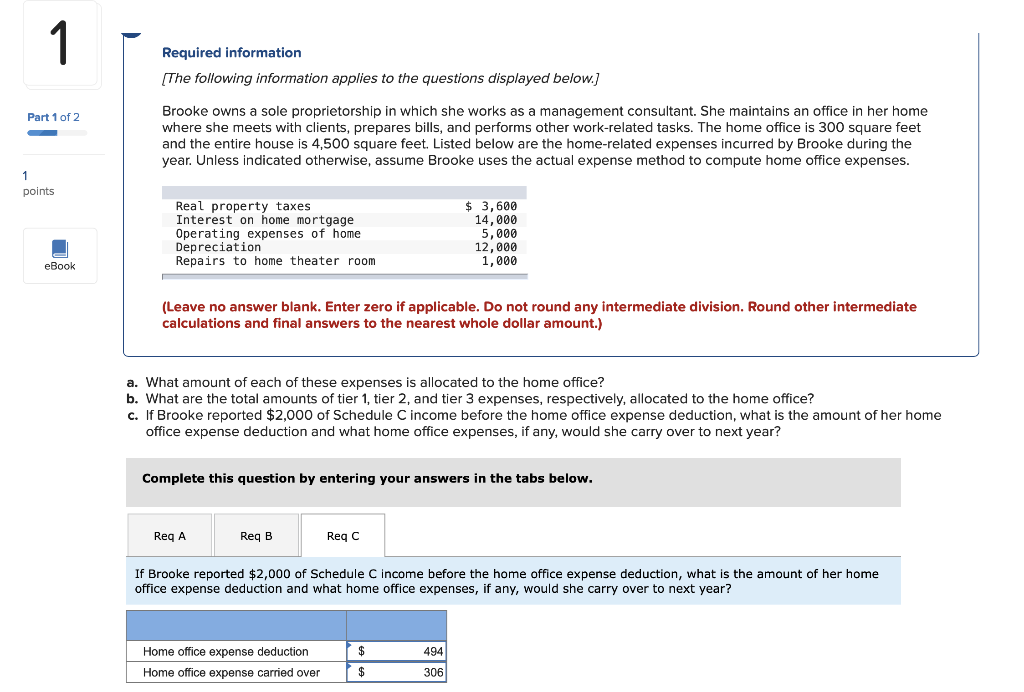

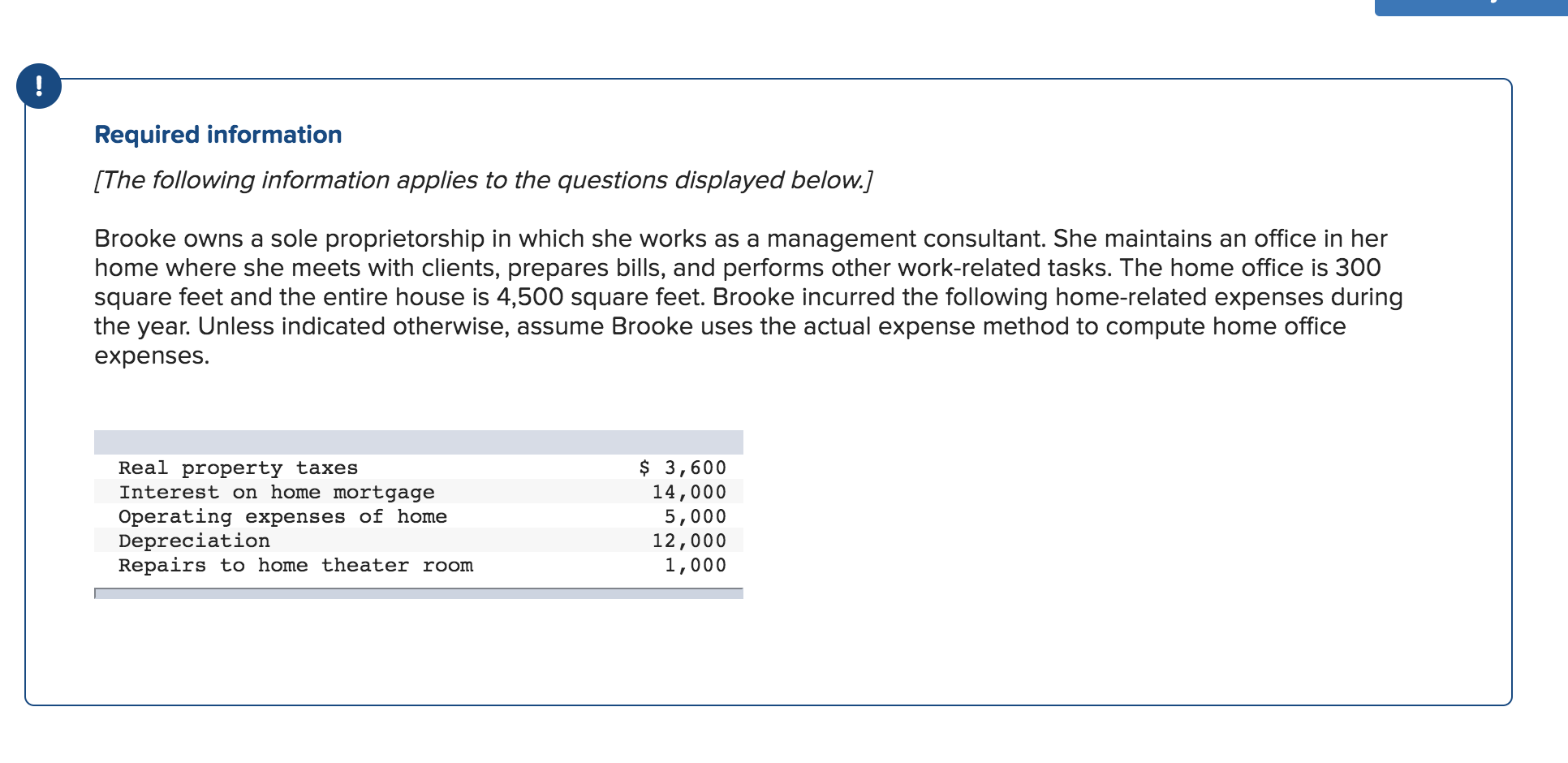

Solved Brooke owns a sole proprietorship in which she works

How To Fill Out Your 2022 Schedule C (With Example)

Rev. Proc. 2013-13: A New Option for the Home Office Deduction

How to Fill Out Schedule C — Oblivious Investor

Form 8829 Instructions: Claim Home Office Deduction – NerdWallet

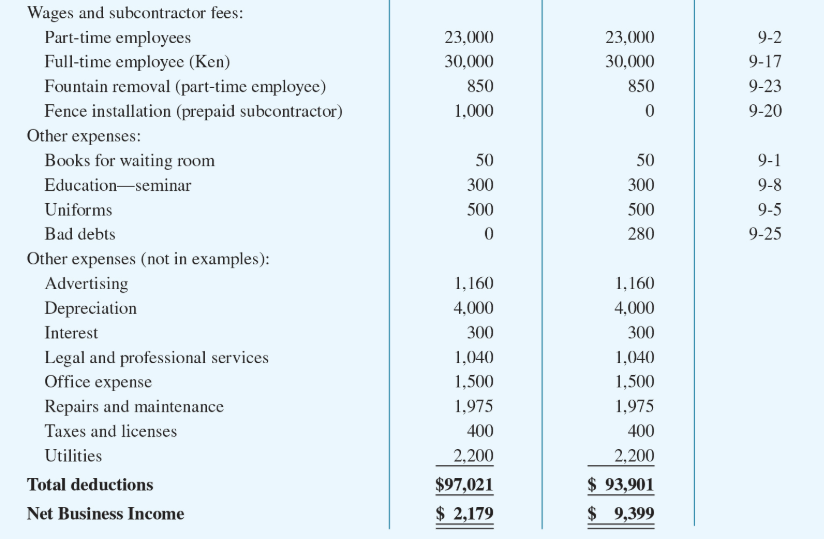

Solved 1 Required information (The following information

How to Fill Out Form 8829 (Claiming the Home Office Deduction) — Oblivious Investor

:max_bytes(150000):strip_icc()/ScheduleC2-2743593ab1f6477bb5702718892b5b38.jpg)

What Is Schedule C? Who Can File and How to File for Taxes

Form 8829 – Office in Home

Schedule C Tax Form: Who Needs To File & How To Do It

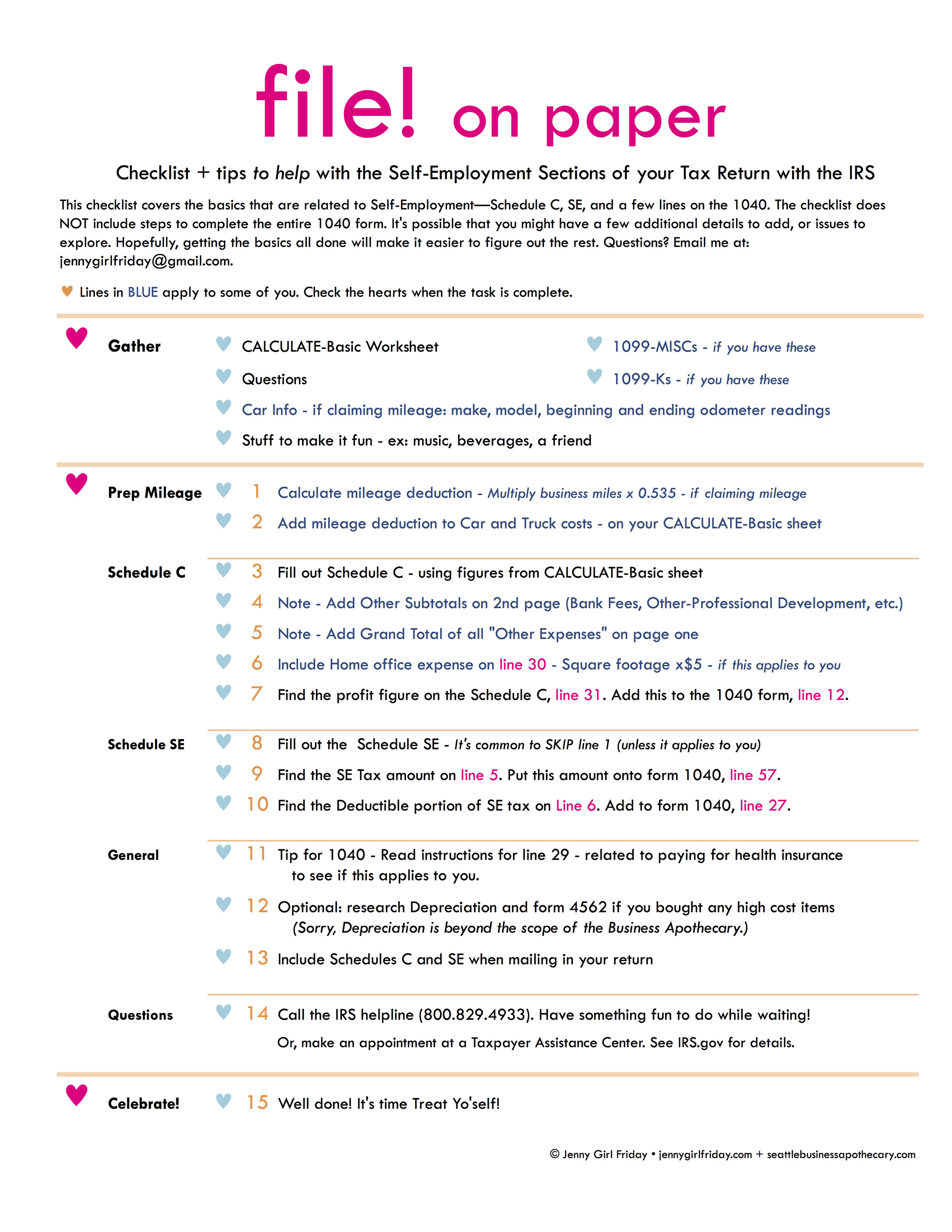

IRS Tax Prep — SEATTLE BUSINESS APOTHECARY: Resource Center for Self-Employed Women*

Your Home Office & Tax Deductions for Small Business

8829 – Simplified Method (ScheduleC, ScheduleF)

How to Fill Out Your Schedule C Perfectly (With Examples!)

Tax Planner Pro Blog: 10 Tax Strategies for Schedule C Taxpayers: What, How, and Where

How to Fill Out Your Schedule C Perfectly (With Examples!)

The Top Ten 1099 Deductions If You’re Self-Employed — Stride Blog

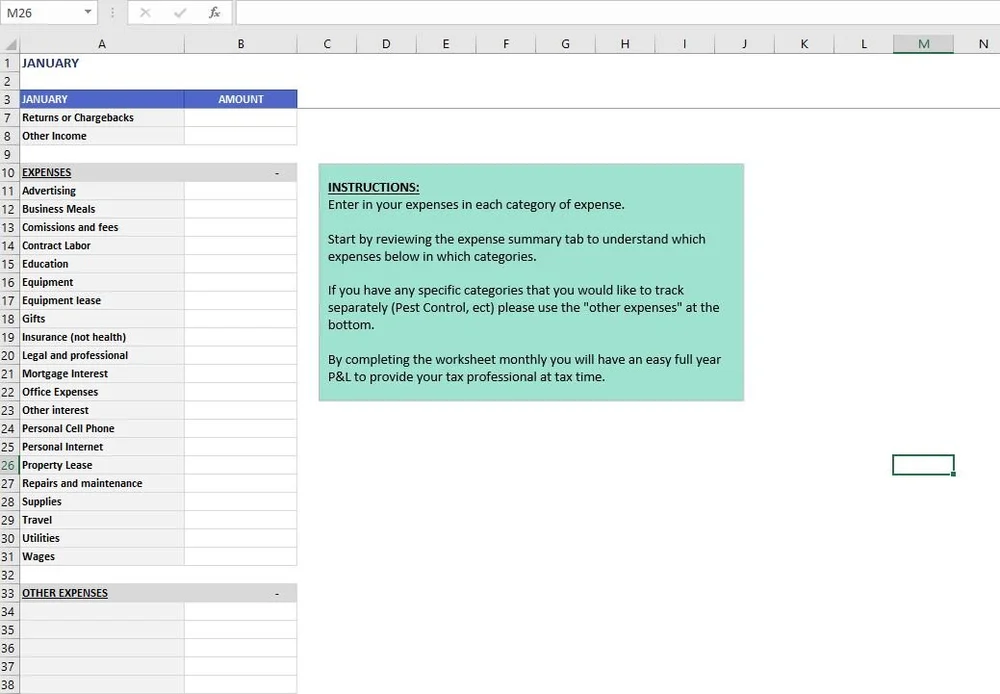

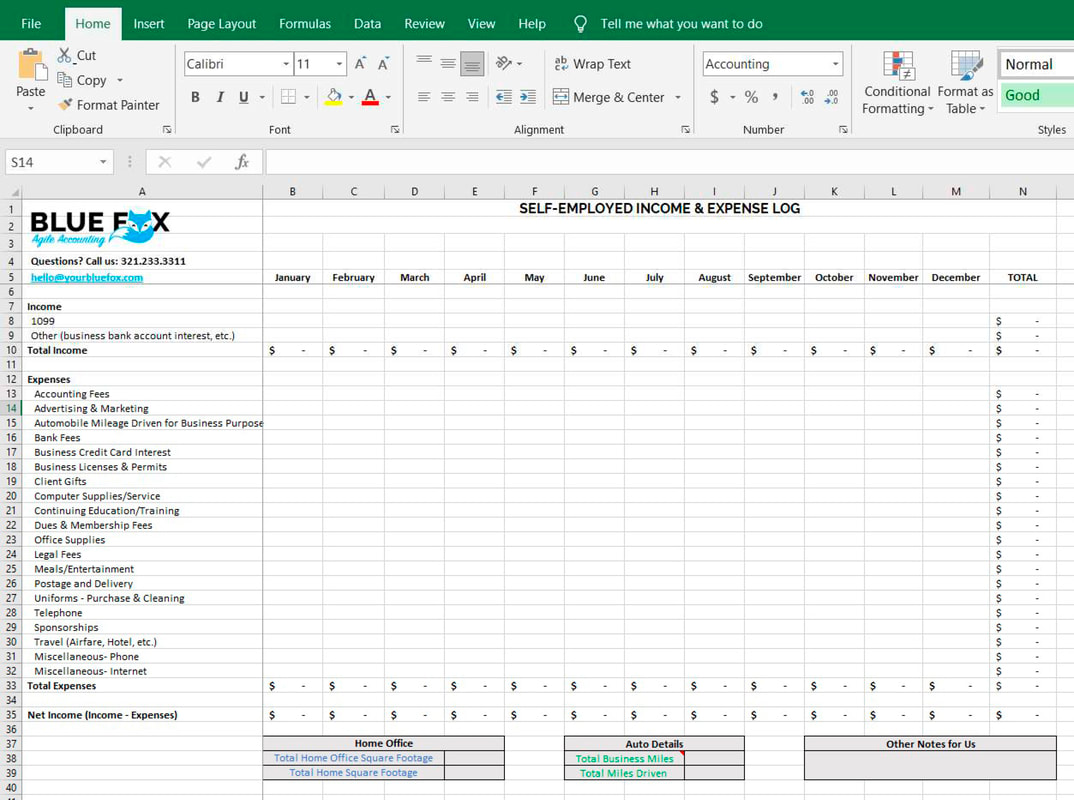

Schedule C Real Estate Agent Income & Expense Tracker — Kolodij Tax & Consulting

The Home Office Deduction – TurboTax Tax Tips & Videos

Home Office Deduction, Schedule C, Form 1040, Form 8829. How to write off your home office. – YouTube

Free Download: Schedule C Excel Worksheet for Sole-Proprietors – BLUE FOX | Accounting for Nonprofits and Social Enterprises

14104: Schedule C – Taxpayer Disposed of Business

Why Schedule C Tax Form Is Considered an Important – The Video Ink

Required: a. What amount of each of these expenses is

18 Commonly Missed Small Business Tax Write-offs – Shoeboxed

Tax Deductions Guide — Sunlight Tax

What Is Schedule C (IRS Form 1040) & Who Has to File? – NerdWallet

How To Fill Out Your 2022 Schedule C (With Example)

Two Schedule C businesses using same home office

What Can You Write Off As a Business Expense on a Schedule C?

How To File Schedule C Form 1040 | Bench Accounting

Publication 587 (2022), Business Use of Your Home | Internal Revenue Service

10 Tax Strategies for Schedule C Taxpayers: What, How, and Where – Morris + D’Angelo

Year End Considerations for Small Business

IRS Form 1040 Schedule C (2021)

Can You Take a Home Office Tax Deduction?

Publicaciones: schedule c office expense

Categorías: Coffee

Autor: Abzlocalmx

Reino de España

Mexico