Arriba 44+ imagen home office expenses

Introduzir imagem home office expenses.

![The Best Home Office Deduction Worksheet for Excel [Free Template] The Best Home Office Deduction Worksheet for Excel [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349b18d4a6db382f5149518_home-office-expense-worksheet.png)

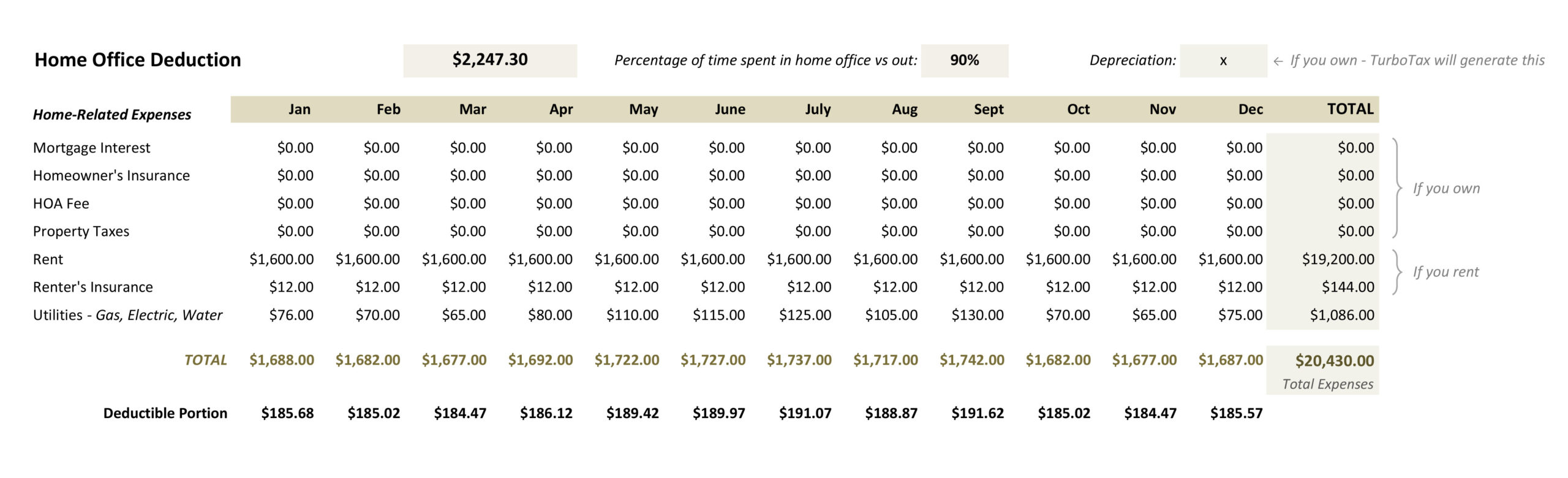

The Best Home Office Deduction Worksheet for Excel [Free Template]

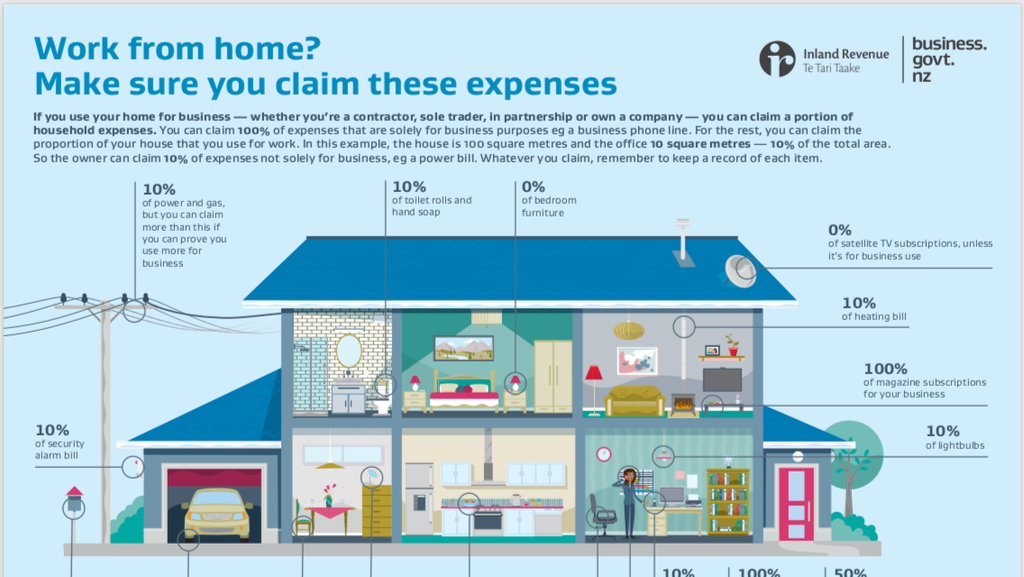

Home Office Expense Costs that Reduce Your Taxes

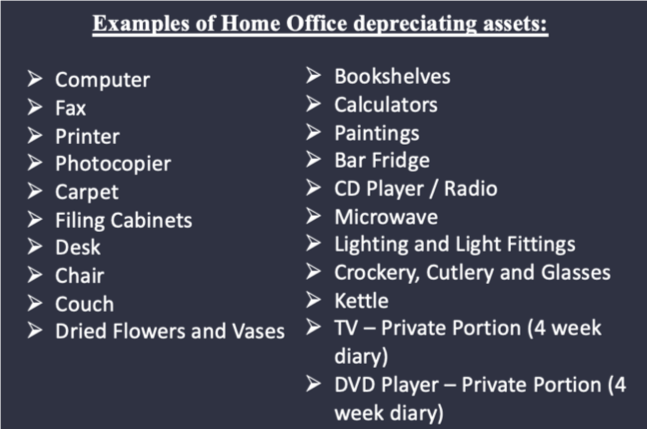

Home Office Expenses: The Essential Guide – BOX Advisory Services

![The Best Home Office Deduction Worksheet for Excel [Free Template] The Best Home Office Deduction Worksheet for Excel [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349b3beeeb5b066ac98f471_home-office-expenses-spreadsheet-dragging-down-formula.png)

The Best Home Office Deduction Worksheet for Excel [Free Template]

Home Office & Work From Home Expenses | SocietyOne

Stephen Larsen and Co, Palmerston North and Wellington: Claiming Home Office Expenses

Calculating Your Home Office Expenses As a Tax Write-Off // Free Template! – Lin Pernille

Deducting home office expenses – Journal of Accountancy

Home Office Expenses – Superior Accounting Group

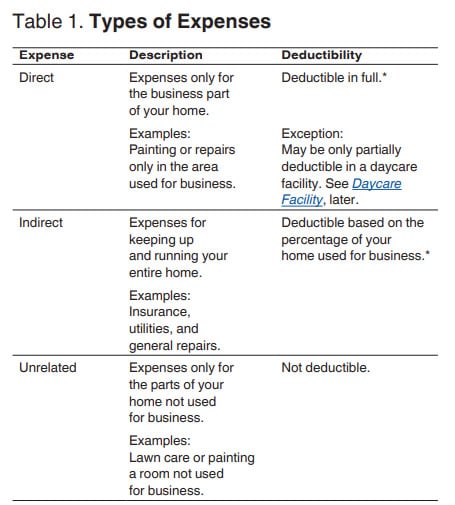

Home Office Expense Costs that Reduce Your Taxes

![The Best Home Office Deduction Worksheet for Excel [Free Template] The Best Home Office Deduction Worksheet for Excel [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349b3336fe7a9eecb8bd7da_home-office-expenses-worksheet-deductible-amounts.png)

The Best Home Office Deduction Worksheet for Excel [Free Template]

How should clients claim home office expenses this tax season? | Investment Executive

Home Office Expenses You Can Claim – KMT Partners

Home Office Expense Costs that Reduce Your Taxes

Canada Revenue Agency – Are you an employee working from home due to COVID-19 and looking to claim the home office expenses deduction? There are two ways to claim the deduction: ?️

The Home Office Deduction – TurboTax Tax Tips & Videos

Home office expenses claim -July 2014

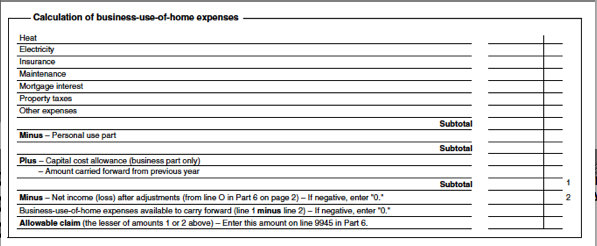

Claiming Home Office Expenses Tax Deduction – Canadian Business Use of Home

Business Tax Tips – Home Office Expenses the ATO allows you to claim – Bookkeepers and Business Owners

![Can I Take the Home Office Deduction? [Free Quiz] Can I Take the Home Office Deduction? [Free Quiz]](https://assets-global.website-files.com/5cdcb07b95678daa55f2bd83/635c647797c263283309177a_Home%20Office%20Guide%20(5).png)

Can I Take the Home Office Deduction? [Free Quiz]

Home Office Deduction – Definition, Eligibility & Limits – ExcelDataPro

Actual Home Office Expenses vs. the Simplified Method – Blue & Co., LLC

Your Home Office & Tax Deductions for Small Business

Cheap Sheets: CPA Prepared Home Office Deduction Worksheet. – Etsy

Claiming home office expenses NZ – The complete guide – Solo

How To Deduct Your Home Office On Your Taxes – Forbes Advisor

Rev. Proc. 2013-13: A New Option for the Home Office Deduction

Simplified Home Office Deduction Explained: Should I Use It?

The Home Office Deduction: Actual Expenses vs. the Simplified Method – Landmark CPAs

Employee Home Office Expenses Deduction – Welch LLP

Employee home office expenses: Special rules for 2020 claims | CPA Canada

The Home Office Expenses Deduction Guide for Employee

Home Office Expenses – Tax Deductions

Run a business from home? You may be able to deduct some expenses.

COVID-19 Home Office Expenses – What You Need To Know

Home office tax deduction for small businesses | MileIQ

FAQ – What Home Office Expenses are Tax Deductible? – Mazuma

Your home office: how to get organized and claim small business expenses

Claiming the Home Office Deduction | Jones & Roth CPAs & Business Advisors

Working from home? You can claim home-office expenses from SARS

:max_bytes(150000):strip_icc()/450824025-F-56a938665f9b58b7d0f95be1.jpg)

Rules for Deducting Business Expenses on Federal Taxes

Can I write off home office expenses during the pandemic?

Employee home office expenses for 2021 | CPA Canada

Claiming home office deductions during COVID-19 | Grant Thornton

Publicaciones: home office expenses

Categorías: Coffee

Autor: Abzlocalmx

Reino de España

Mexico